is an oversold stock bad

Suppose a stock value suddenly falls because of issues in the company bad reports or any mass withdrawals of traders believing that the stock may be overpriced. This can happen for many reasons such as.

It allows you to focus in on stocks or ETFs that are moving in a more extreme fashion than what is normal for them.

. If a stock is oversold it means that the number of sellers outweighs the number of buyers. Just my opinion 200 and 50 dma are much more meaningful for trends if youre looking for some sort of buysell signal. Output for this tool includes the RSI score as well as the stock price MACD volume 52-week high.

With three clicks and within eight seconds you will know exactly how oversold or overbought a stock is and by extension understand whether its next move will be a higher or lower price. Stocks that are oversold could present buying opportunities. It is the other way around Oversold mean there are too many desperate sellers and too little buyer.

I n trading on Tuesday shares of Fortis Inc Symbol. CNBCs Jim Cramer said Thursday that trying to get into. Money investing Investing Insights stock market Wall Street Warren Buffett Carl Icahn.

Streak of Down Days. Published Wed May 4 20221141 AM EDT. Jun 14 2022 1126AM EDT.

Then these stock falls in oversold category. 101 rows The most undervalued stocks in USA. One of the worst rookie mistakes of technical analysts is to think of overbought as bad and oversold as good.

This means that its. FTS entered into oversold territory changing hands as low as 4661 per share. Were taking advantage of this oversold market to buy more of this high-quality stock.

When a stock is overbought with an RSI above 70 all that means is that the price has gone up a lot - thats it. Generally an oversold stock suffers from overreacting traders. A stock can become undervalued as a result of a major sell-off.

The stock markets 4 decline over the past week doesnt sound bad given that the SP 500 is up 22 year-to-date. It is broadly defined when a relative-strength indicator RSI is below 30. Bank of America BAC.

Answer 1 of 9. As opposed to overbought oversold means that a companys stock price has decreased substantially. 25 2021 at 1038 am.

If a stock is oversold does that mean there are more buyers than sellers. 4 Ways to Tell if a Stock Is Oversold. When a stock is oversold it trades at a price below its intrinsic value.

Answer 1 of 4. Like an overbought stock is not necessarily bad the existence of an oversold condition does not mean that the stock is a good stock. There are several free online web portals financial sites that calculate and display this data for you in a simple line graph.

Note stocks can remain overbought or oversold for long-ish periods of time. It might have a temporary mar on its name or something similar. Investors sometimes skip CN due to the low dividend yield which is currently 2.

A big company might be about to release bad news that would hurt its share price. As a result investors sell shares before the. When the price of a stock is going down for long time it can be days months or even years.

Now even though you may do fine using just one definition your results are going to vary a lot with the type of method you go for. 10 hours agoFree cash flow is targeted at 37-40 billion. Causing a crash in.

Oversold stocks can be a great opportunity to make gains. Now this can be for a number of reasons but the most common one is that theres been a major sell off on the back of bad news. Having covered what oversold means and what it tells us about the market its time to have a look at some common methods traders use to define oversold levels in the market.

Technical indicator like RSI remains near 20 for oversold stocks. Put simply it trades at a price thats much lower than it should. Is that a good thing or a bad thing.

Sometimes investors will run from a company. Question is whether it is good to buy them. Cramer says stocks are still badly oversold even after Wall Streets big rally.

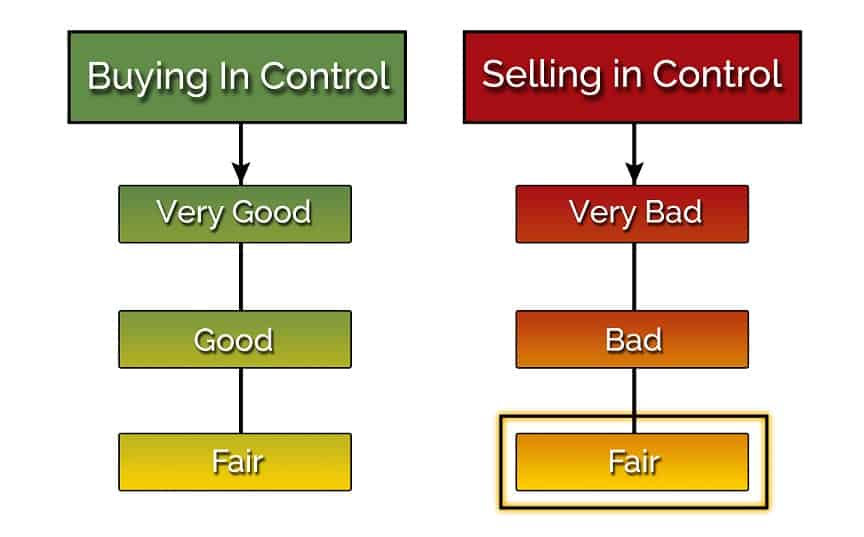

7 of the Best Cheap Stocks to Buy Under 10. When a stock is oversold parties offer the stock beyond the fair value the true value is hard to gauge because everyone calculates differently. It is only one piece of information of the many that should inform your decisions.

Good and Bad News If good news about the company comes into the market it can trigger enough buying interest to drive an overbought stock up through resistance making it more overbought. This might be because of a recent event bad news with the company or a low outlook for the industry. When you buy an oversold stock you might be investing in a well-known company.

We define oversold territory using.

Forget Warning Signs Stocks Are Now Extremely Overbought Seeking Alpha

Best Oversold Stocks To Buy Now For June 2022

Market Oversold The Best Way To Tell If The Market Is Oversold

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

What Does An Oversold Stock Mean Would It Be A Good Buy Quora

Determining Overbought And Oversold Conditions Using Indicators

Oversold Stocks Short Term Marketvolume Com

7 Oversold Stocks To Buy Before They Rebound

Which Is The Simplest And Best Indicator To Know That The Share Is Overbought Or Oversold Quora

Oversold Stocks Intraday Marketvolume Com

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

Forget Warning Signs Stocks Are Now Extremely Overbought Seeking Alpha

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

Best Oversold Stocks To Buy Now For June 2022

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

:max_bytes(150000):strip_icc()/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)

/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)